With a high enough credit score, you can secure an auto loan and great borrowing terms. Keep reading to learn what credit score you need to get an auto loan. And to improve your score, make timely payments, pay off your debts, and monitor your credit with LifeLock Standard to help keep your credit in order and protect against identity fraud.

Before you can drive off the lot in your new car, you need to get through the bank or the dealership’s financing department. It’s easier to do this when you have everything you need already — think: paystubs, details about other debts, and, most important, a good credit score.

A “good” credit score can mean different things to different people. However, most dealerships share a similar opinion. Throughout the article, we’ll define the ideal credit score for an auto loan and tell you how to get one even if your credit isn’t quite where you want it.

What is a good credit score for an auto loan?

Getting an auto loan doesn’t have a set credit score minimum. But, you should strive for at least a 661 credit score to increase your approval odds for a used car loan and 680 or above for better borrowing terms. For a new car, you’ll likely need a score closer to a 730.

Can you get an auto loan with bad credit?

Auto loans are still available to people with credit scores under 661. Still, you might need a co-signer or a larger down payment. Or, you might have to accept sub-optimal borrowing terms, including a shorter repayment term and higher interest.

At the end of the day, it depends on the lender’s criteria and other factors like your income and total amount of debt.

How can I improve my auto loan approval odds with a lower credit score?

The best way to improve your approval odds is to increase your credit score by paying off your debts on time every month. However, if you’re looking for a quicker fix, there are a few options:

- Show proof of income: If you earn a high enough income, you may show lenders that you are now in a position to manage your debts effectively.

- Pay a larger deposit: If you pay a larger deposit, you can take out a smaller loan.

- Work with the right lenders: Some auto lenders specialize in loans for people with poor credit, and loan officers at those organizations can help you get approved.

- Find a co-signer: Ask someone with good credit, and someone you trust such as a family member, to put their name on the auto loan so you can qualify and get better loan terms.

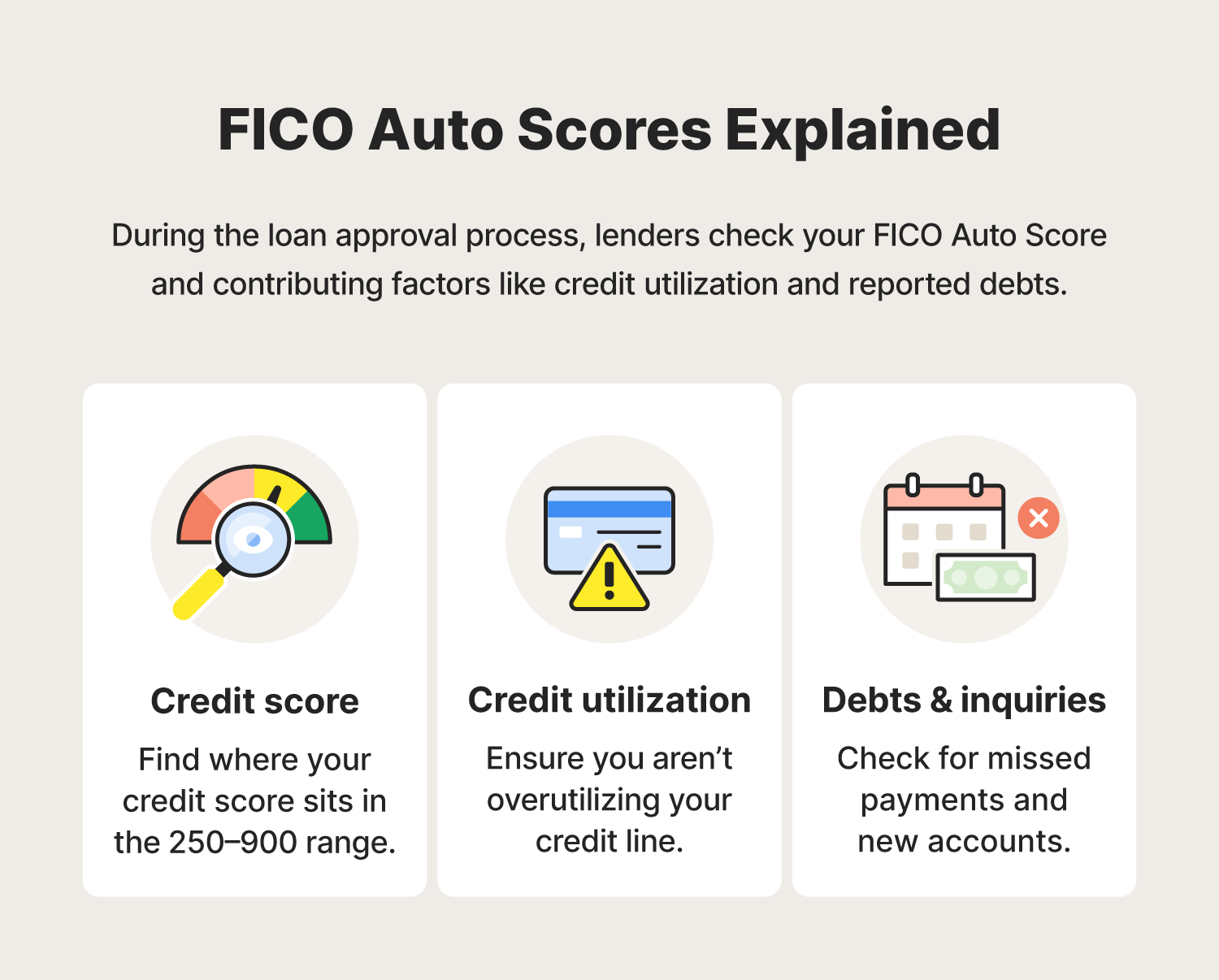

How do auto lenders check credit scores?

Auto loan lenders use a special credit scoring model called FICO® Auto Score, which ranges from 250 to 900. However, some do use VantageScore credit scoring models 3.0 and 4.0. Regardless, both scores consider the same factors as a traditional credit score. For example, lenders might check your:

- Payment history: This is to verify that you pay your bills on time.

- Credit utilization: Lenders check this to ensure that you aren’t overutilizing your lines of credit.

- Credit history: It’s important for lenders to see how many years of experience you have successfully managing debt.

- Credit mix: Lenders also need to see how capable you are of handling different types of debt.

- New credit lines: Before you can get a loan from an auto lender, they need to verify that you aren’t taking on more debt than you can manage.

However, the FICO Auto Score stops certain factors from hindering your ability to get a new (or new-to-you) car. For example, the auto credit score doesn’t penalize borrowers for paying off a debt that went to collections or unpaid medical bills.

5 ways to improve credit before applying for a car loan

If you have time, it’s usually better to improve your credit score by steadily paying off different types of debt over time. But that’s just the start. Here are a few other ways to improve your credit if you have time before you need to get in a new car.

1. Pay bills on time

Payment history accounts for a whopping 35% of your entire credit score. That said, paying your bills — credit cards, mortgages, student loans, medical bills, etc. — can significantly impact your credit score. This should be a top priority as you work to improve your credit score and qualify for a car loan.

2. Keep your credit utilization low

Maintaining a low credit utilization ratio (the percentage of your available credit that you're currently using) positively impacts your credit score. Lenders are more likely to offer loans to people with lower credit utilization because it shows they are good at managing credit.

3. Limit credit applications

Avoid applying for multiple credit lines or loans that involve hard credit checks. Otherwise, you might get hit with several checks at once that end up tanking your credit score. If you plan to get an auto loan soon, avoid applying for major loans like mortgages and credit cards.

You should also avoid co-signing for someone else until your credit is better since you will be responsible for that debt in the lender’s eyes, even if you aren’t helping make payments.

4. Dispute inaccurate entries

Discrepancies on your credit report can unfairly affect your score — report them to give yourself a credit boost. To do this, look for inaccuracies about your financial behavior, like missed or late payments, account statuses, collections errors, and credit inquiries.

You can also check for indicators that someone is using your identity, like new credit lines, drastic changes in your credit score, inaccurate personal information, and missing accounts. Double-checking this will ensure someone else isn’t responsible for your lackluster scores.

5. Diversify your credit mix

You can diversify your credit by opening different types of accounts like credit cards, mortgages, and installment loans. This mix of credit is an added bonus to lenders because it shows that you have experience responsibly managing different types of debts.

After seeing this, they may be more inclined to approve you for an auto loan with favorable terms.

How do auto loans affect credit scores?

The hard credit inquiry lenders initially run will cause your credit score to drop temporarily. However, it will improve relatively quickly if you make timely payments.

Will getting pre-approved for a car loan affect your credit score?

This depends on your lender. Many use hard credit checks to pre-approve or pre-qualify borrowers. However, some do use soft checks, which don’t impact credit scores.

If you already have a fair to poor credit score, it might be best to go with a lender who uses soft checks to avoid additional credit score dips.

Is buying a car a good way to build credit?

Yes, buying a car is a good way to build credit because it:

- Improves your payment history: Making payments on time shows lenders that you won’t pay them late or miss payments.

- Increases the length of your credit history: Car loans are usually 60 to 72 months (five to six years). By paying off a loan over the next few years, you will have a lengthier credit history, which is a good sign to lenders — as long as you haven’t missed payments.

- Increases your credit mix: If you only have credit cards, an auto loan can help diversify your credit and increase your credit score.

Build and monitor your credit

A good credit score is the key to getting approved for an auto loan with low interest rates and great borrowing terms. If your credit score isn’t where you want it to be, it can be soon. Prioritize regularly reviewing credit reports, disputing inaccuracies, and managing your credit responsibly .

For an extra boost, use a trusted credit monitoring service like LifeLock Standard for help canceling and replacing important cards if your wallet is stolen, limited stolen funds reimbursement‡, and credit monitoring of your financial accounts. LifeLock Standard can help keep your identity safe as you start your credit-building journey.

FAQs about credit scores for auto loans

Still have questions about auto loans and credit scores? Here’s what you need to know.

Will it hurt my credit score if I check it before applying for an auto loan?

Checking your own credit won’t hurt your credit score because it’s just a soft pull. Always check your credit score before applying for an auto loan to ensure you find the right lender and good borrowing terms.

However, getting pre-approved or pre-qualified involves a hard pull. So, if a bank runs a check, you can expect your credit score to dip.

How long will a lender credit inquiry impact my credit score?

A hard inquiry from a lender typically affects your credit score for about 12 months, but its impact dissipates over time. After the initial hard pull, it usually shows up on your credit report for two years before dropping off your credit report.

Can I get an auto loan with a low credit score and high income?

Yes, securing an auto loan with a low credit score and a high income is possible. Lenders consider several factors when assessing an applicant’s eligibility.

Just remember that you might have to accept higher interest rates or shop with a financier specializing in loans for people in your situation.

Can I qualify for a car loan with no credit history?

Yes, you can qualify for a car loan without a credit history, but it’ll be more difficult. Vehicles are big-ticket items, and many lenders will be wary of loaning money to people who haven’t established fiscal responsibility.

‡ Up to $1 million for coverage for lawyers and experts included on all plans. Reimbursement and Expense Compensation varies according to plan, up to $1 million each for LifeLock Ultimate Plus. Insurance benefits are issued by third parties. See NortonLifelock.com/Legal for policy info.