Regular credit score monitoring is a smart way to uncover identity theft attempts early, helping to prevent cybercriminals from stealing your information and inflicting serious damage. Learn when and how often credit scores update. Then, supercharge your defenses and help protect against identity theft with LifeLock Ultimate Plus.

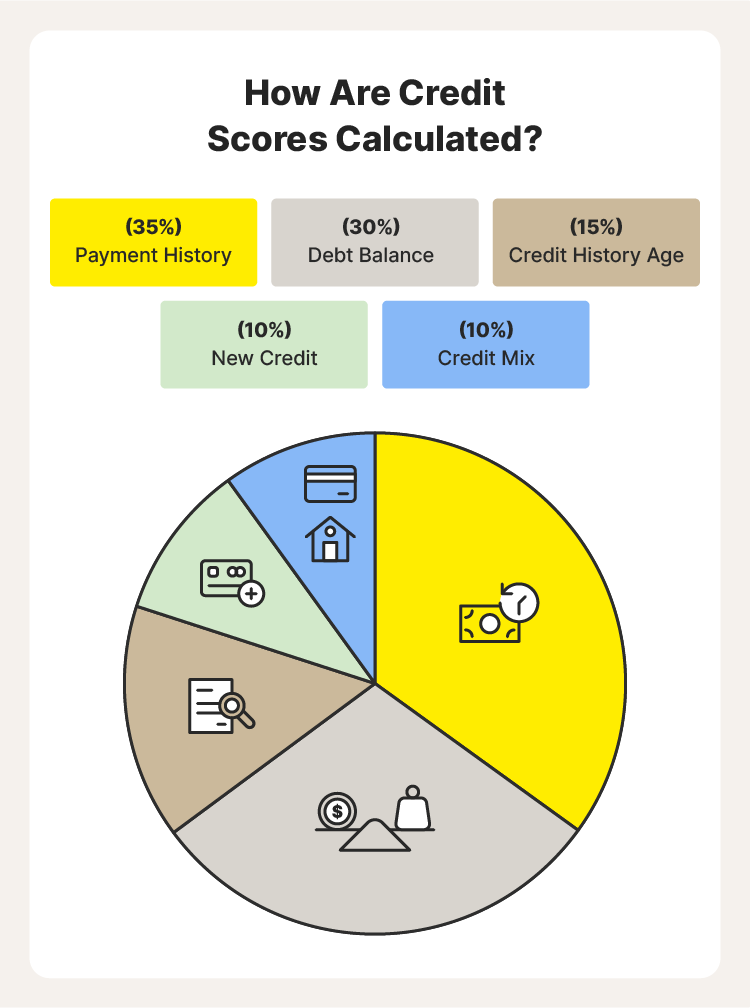

Your credit score is a three-digit number that the credit bureaus calculate to show how well you’ve managed your debts. The higher your credit score, the more likely you’ll qualify for loans and get better interest rates. Your credit score can move up or down based on the following:

- Your track record of making payments on time

- Your credit utilization rate and how much you owe

- How long you’ve had open credit accounts

- New credit accounts

- The types of credit you have

When do credit scores update?

The three major credit bureaus—Equifax, Experian, and TransUnion—all update credit scores at least once a month. However, there isn’t a specific day of the month when your credit report is guaranteed to refresh. Instead, credit score updates depend on when creditors report your payments to the credit bureaus.

Because your credit score fluctuates as creditors report the payments you make and miss, you might even notice daily changes.

How long does it take to get your first credit score?

If you don’t have any credit history, it can take up to six months for you to get your first credit score. To get a credit score faster, you’ll need to start taking on new debt and paying it off consistently.

You can start with a secured credit card, a credit-builder loan, or become an authorized user on someone else’s credit card.

How often do credit bureaus update credit scores?

Differences in how and when credit bureaus calculate your credit score are usually a result of creditors not reporting debts and payments to all bureaus at the same time or at all. Not to mention that the FICO® Score and VantageScore®—scoring models that credit rating agencies use to generate credit score numbers—use different algorithms to calculate credit scores.

How often does Equifax update your credit score?

Equifax calculates and updates credit scores at least once a month. However, the credit bureau does say there’s a chance you could see your credit score move up and down throughout the month if you have a unique financial situation.

Also, if you need to see your new credit score sooner to qualify for a loan, you can ask the lender to start a rapid rescoring process, which takes three to five business days with Equifax.

- Credit score: Equifax uses the VantageScore 3.0 credit scoring model but bases numbers on Equifax data.

How often does TransUnion update your credit score?

TransUnion usually updates credit scores once a month or more. However, it can take up to 45 days in some cases. If you want to see your score improve quickly, you can try TransUnion’s credit score simulator to see what debts will have the most significant overall impact.

- Credit score: TransUnion uses the VantageScore 3.0 credit scoring model but bases numbers on TransUnion data.

How often does Experian update your credit score?

Experian also updates credit scores at least once a month. However, you might be able to improve your credit score faster when you use the Experian Boost feature. This feature allows you to track phone, insurance, streaming, and rent bills—and that’s just the start. Because Experian documents all of the payments you make, it’s more likely that you’ll see your credit score go up.

- Credit score: Experian uses the FICO Score 8 model but bases numbers on Experian data.

How often do credit score websites check your credit?

Credit bureaus typically update credit scores monthly, sharing new information with third-party websites and lenders. However, the reporting frequency can vary, so some third-party credit check websites may update more often than others.

How often does Credit Karma update your credit score?

When Credit Karma updates your credit score, they’ll also give you a rundown of what factors changed in the last month and share suggestions of high-impact payments you can make to improve your credit score quickly.

However, the credit checker website doesn’t share Experian data or FICO Scores. This means there's a chance you might miss out on part of the picture if your creditors report your debt to another bureau.

- Credit score: Vantage 3.0 from Equifax and TransUnion

How often does LifeLock Ultimate Plus update your credit score?

LifeLock Ultimate Plus offers monthly one-bureau credit score tracking. Aside from that, the tool also monitors open accounts and credit inquiries, helps users detect fraud early, and enables users to report credit report errors. Overall, this makes it easier for people to protect their identity and make ongoing improvements that positively impact their credit scores.

- Credit score: VantageScore 3.0 from Equifax, Experian, and TransUnion

Get LifeLock Ultimate Plus to help keep track of recent credit changes so you can keep building your credit score and detect identity theft early.

How long does it take for information to fall off your credit report?

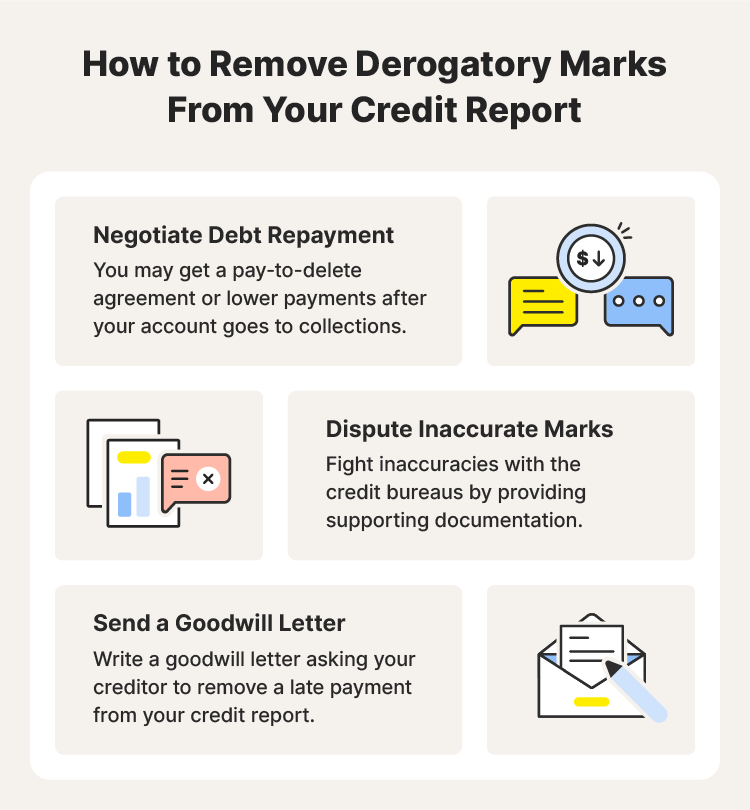

A bad mark usually takes around seven years to “fall off” your credit report. The removal usually happens when a negative entry (like a late payment or bankruptcy filing) gets removed from your credit report or the debt runs out the clock. However, you can sometimes get negative marks taken off early.

Generally, you can do this by negotiating a pay-to-delete agreement, disputing incorrect entries, or sending a goodwill letter asking the creditor to remove the bad mark from your credit report.

Here are some examples of derogatory marks that can hurt your credit score:

- Hard inquiries are credit checks a lender runs when you apply for a new loan or line of credit; these stay on your credit report for two years.

- Repossessions occur when a lender takes possession of your collateral because of missed payment; it takes seven years for these to fall off.

- Foreclosures involve a lender reclaiming your property because of missed mortgage payments; it takes seven years for this mark to fall off.

- Collections is where your debt goes when the original creditor sells it to a debt recovery agency after you miss payments; these remain on your credit report for seven years.

- Bankruptcy can provide financial relief when you’re deep in debt; Chapter 7 bankruptcy stays for ten years, and Chapter 13 sticks for seven.

- Late payments can stay on your credit report for up to seven years.

- Debt defaults happen when you stop making payments on a loan; they typically take seven years to fall off a credit report.

What’s the fastest way to see my latest credit score?

If you’ve been working on establishing a good credit score, you can use a rapid rescore to see your latest, most accurate credit score. This process can often give your credit a modest bump up, help you qualify for a loan, and secure better borrowing terms.

Rapid resources are often used for mortgage approvals, but you can talk to any loan lender about using the service. Your lender will need to start the rapid rescoring process since you can't do it alone.

Protect yourself from the threat of identity theft

Some people’s credit scores only update once a month. That might be enough in most cases, but it can be an ineffective way of monitoring for threats like identity theft. With careful monitoring and tools like LifeLock Ultimate Plus, you can do more to help protect yourself against identity theft and fraud with access to real-time fraud alerts.

FAQs about credit scores

Still have questions about credit scores and how they change? Here’s what you need to know.

What is a credit score?

A credit score is a number that shows how well you manage your debts. Credit scores measure how financially responsible you were in the past and predict future behavior. For example, your credit score can indicate how likely you are to make timely payments or exhaust your credit line.

The VantageScore and FICO Score are the most common types—both range from 300 to 850.

Can my credit score change daily?

Yes, your credit score can change every day. If several creditors report your debts to credit bureaus on the same day, it might change several times daily.

Are real-time credit score updates safe?

Real-time credit score update services from respected companies like banks, credit unions, credit bureaus, and well-known credit websites are usually safe. However, you should always research the real-time credit score reporting service before using it to prevent identity theft.

How long does it take for a credit score to update after I make a payment?

Credit scores typically update within a month after you make a payment. Still, the exact timing can vary based on when creditors report to the credit bureaus and when they update their records.