While reviewing your credit score, you may have come across names like TransUnion, Experian and Equifax. These are the three main credit bureaus in the U.S. Keep reading to learn how they operate and what they do with your personal information. Then sign up for LifeLock Standard to help monitor your credit, detect fraud, and protect against identity fraud.

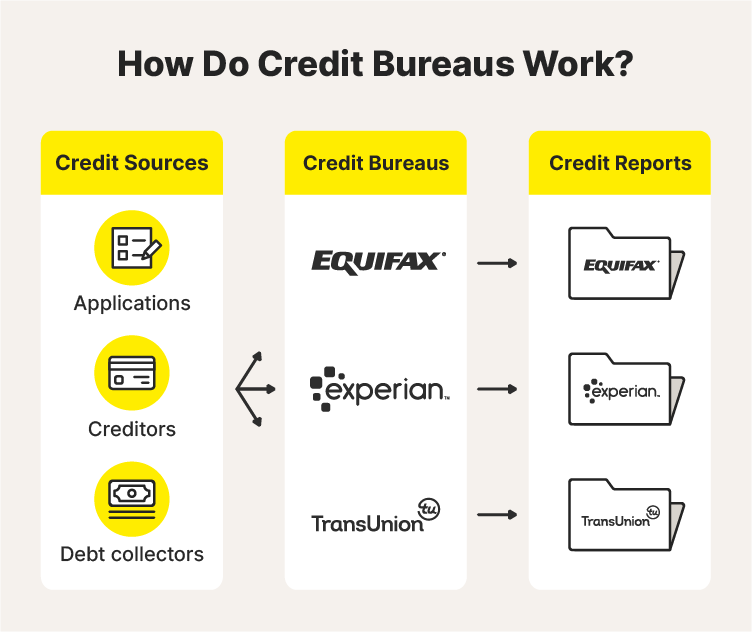

A credit bureau collects and maintains your credit information via a credit report, which lenders assess to make informed decisions regarding loans, credit cards, and similar financial transactions. There are three major credit bureaus in America.

What are the 3 credit bureaus?

The three credit bureaus are TransUnion®, Experian® and Equifax®.

Also known as credit reporting agencies (CRA), credit bureaus are businesses that gather data from creditors, lenders, and public records to create credit reports and credit scores.

All three credit agencies began as different businesses that later evolved into the well-known bureaus they are today. These are the three main credit bureaus:

Equifax

Equifax originated in 1899 as the Retail Credit Company (RCC) in Atlanta, Georgia. Initially focused on providing local credit information, it expanded over the years and rebranded as Equifax in 1975.

Experian

Experian traces its roots to 1980 when Bain Capital and Thomas H. Lee Partners acquired TRW Information Services. After spinning off in 1996, it became Experian.

TransUnion

TransUnion was founded in 1968 as the Union Tank Car Company Credit Bureau in Chicago, Illinois. It emerged through a merger with the Credit Bureau of Cook County.

How credit bureaus operate

Credit bureaus operate by collecting and maintaining financial information on individuals and businesses. Here is an overview of how a credit bureau facilitates your credit data:

- Businesses report data to credit bureaus. As part of their regular operations, businesses contribute details about individuals' credit accounts, payment histories, outstanding debts, and any public records like bankruptcies.

- The bureaus generate credit scores. Based on this information, the three credit bureaus provide numerical representations of credit risk.

- Lenders purchase this data. To assess the creditworthiness of individuals before making decisions about extending credit, lenders buy the data from credit bureaus.

Additionally, credit bureaus offer services such as placing credit freezes that allow individuals to restrict access to their credit reports. This can help prevent unauthorized access and protect against identity theft.

What credit bureaus do with your information

Credit bureaus compile comprehensive credit reports that leverage your financial information to compute credit scores (numerical representations of your creditworthiness). The two main types of credit scores are FICO® and VantageScore®. You can often get a free FICO score at your bank, credit card company, or credit union.

Not every business reports to the same bureau, that’s why you may have a higher credit score at one over another.

Each bureau also calculates credit scores differently, often resulting in a unique score at each bureau. Let’s review how each bureau weighs each credit score factor.

How Equifax calculates your score

Equifax credit reporting composes your score based on the following weighted factors:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- New credit accounts (10%)

- Types of credit used (10%)

How Experian calculates your score

An Experian credit report generates a FICO score with the same weight structure as Equifax:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- New credit accounts (10%)

- Types of credit used (10%)

Though Equifax and Experian have the same weight distribution, they use a different score range so you can still end up with a different score.

How TransUnion calculates your score

Here’s how a TransUnion credit report creates your credit score:

- Payment history (40%)

- Credit utilization (20%)

- Length of credit history (21%)

- Reported balances (11%)

- New credit accounts (5%)

- Available credit (3%)

Since each credit bureau calculates your score differently, check your credit score at each bureau to see why you have better credit at one over another. Don’t worry, your score doesn’t lower when you check it.

Disputing credit reports at each bureau

If there are any discrepancies or inaccuracies, you can file a credit report dispute with the credit bureau to correct it.

A credit report from each bureau can appear different for the following reasons:

- Businesses report to different bureaus. Some entities may only report to one bureau.

- Incoming data can be inconsistent. Institutions may share different data about your finances with each bureau.

- Bureau calculation methods differ. The bureaus don’t all use the same weighting or scoring system.

- Some information may not be reported. An entity may not share your financial information, such as timely rent payments.

If you’d like to dispute an inaccuracy, here is the contact information for each credit bureau.

| Credit Bureau | Online Support | Phone Number | Mailing Address |

| Equifax | Equifax online self service (click ‘Dispute’) | 1 (888) 378-4329 | Equifax Information Services LLC, P.O. Box 740256, Atlanta, GA 30374 |

| Experian | Experian online dispute | 1 (866) 200-6020 | Experian, P.O. Box 4500, Allen, TX 75013 |

| TransUnion | TransUnion disputes | 1 (800) 916-8800 | TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA 19016-2000 |

It's important that you regularly monitor your credit reports for accuracy and check your credit scores to remain proactive against fraudulent activity. If you detect suspicious activity, you can contact the credit bureaus to enable a credit lock or credit freeze.

Monitor and protect your credit

While getting your free credit reports each year is a good first step in monitoring your credit, it may not be enough to help you catch or stop identity theft before damage has been done.

With LifeLock Standard, you get credit monitoring at a top credit bureau, assistance identifying and removing your data from public people-search sites, and alerts if your personal information is detected on the dark web. With those tools, you’ll be able to take action to help protect against identity fraud.

FAQs about the three credit bureaus

Still have questions about the three credit bureaus? We’ve got answers.

What are the differences between the credit agencies?

The main difference between the credit agencies Equifax, Experian, and TransUnion is their proprietary scoring models. The credit bureaus weigh credit score factors differently and use different score ranges, resulting in unique scores.

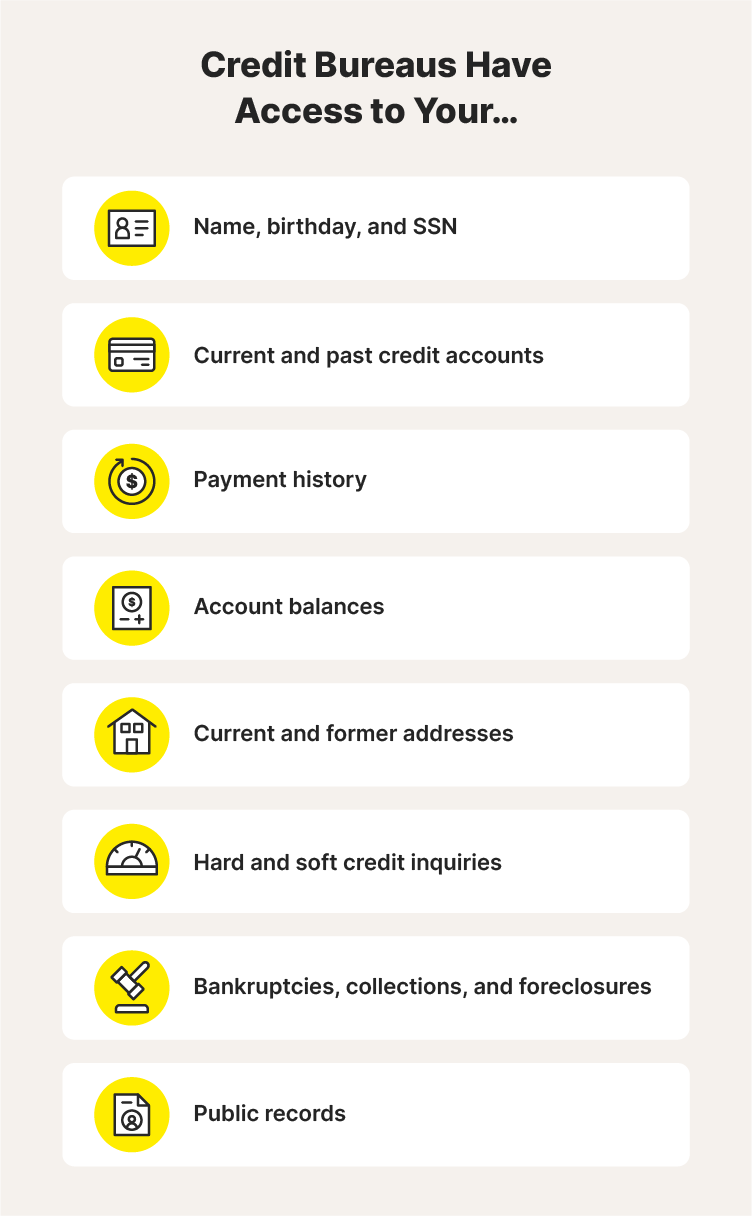

What information do the major credit bureaus collect?

Credit bureaus collect the following information to create your credit report:

- Your name, birthday, and SSN

- Current and past credit accounts

- Payment history

- Account balances

- Current and former addresses

- Hard and soft credit inquiries

- Bankruptcies, collections, and foreclosures

- Who has accessed your credit report

Since businesses report differently to each bureau, all credit reporting agencies develop unique credit scores based on the information above.

Which of the three credit bureaus is most accurate?

There is no definitive answer as to which of the three major credit bureaus — Equifax, Experian, or TransUnion — is the most accurate. The assessments of all three bureaus can vary due to differences in data sources and scoring models.