Criminals may use rental scams to steal funds or sensitive information from unsuspecting renters. You may have heard about this fraud on the news or from a concerned loved one. Online scams can be alarming but don't swear off real estate websites just yet. This guide will explore what rental scams are, how to spot them, and how LifeLock Standard can help reduce the risk of this scam.

What is a rental scam?

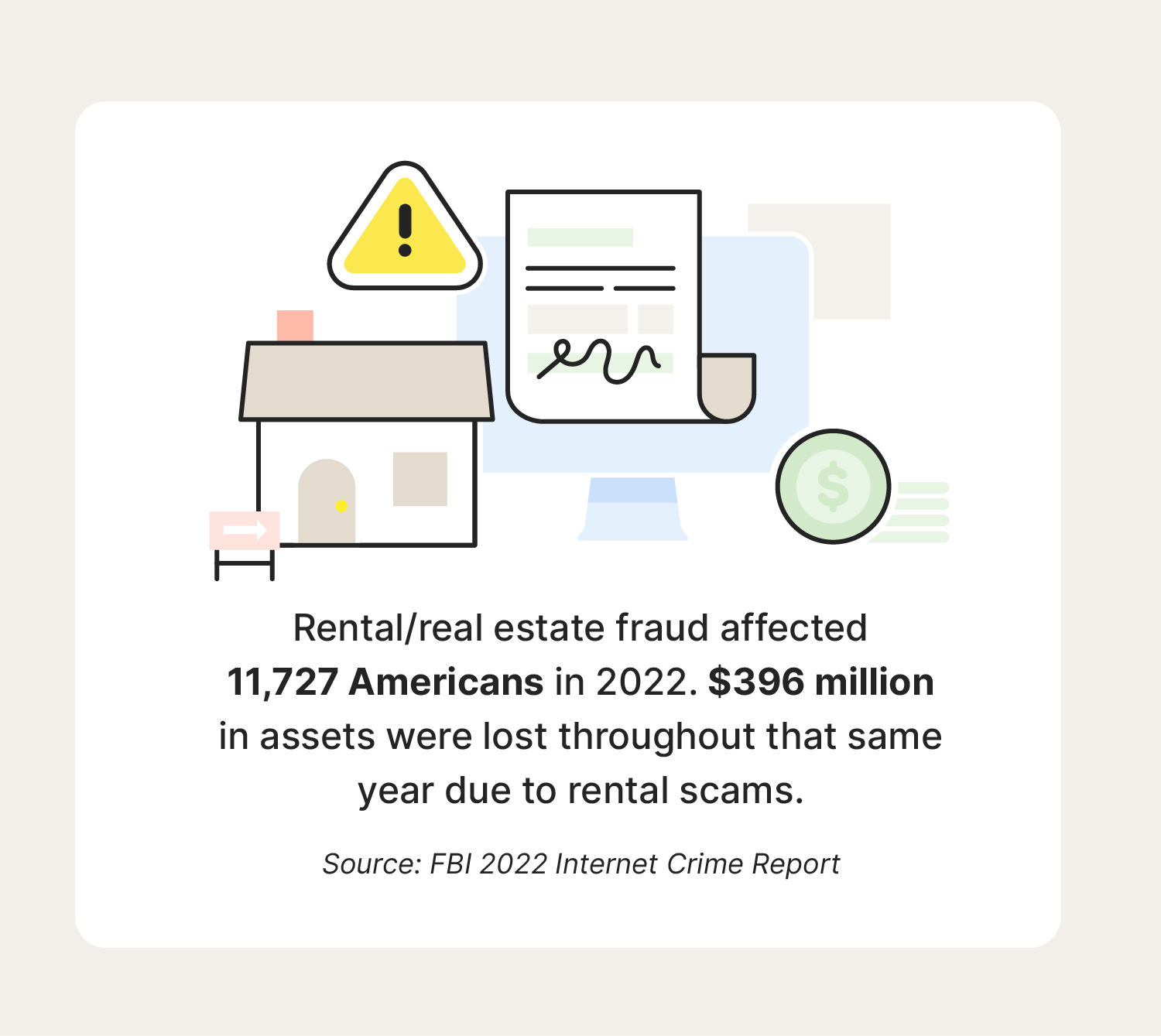

A rental scam is when someone deceptively uses rental property listings to gain access to someone else’s personal information or finances. Rental fraud can occur in a variety of ways. Scammers can trick people into signing fake rental leases or carry out a security deposit scam, where they ask for payments for properties that aren’t available.

Rental scams exist in various forms that have their own nuances. Some scams are much easier to detect than others, but all of them have distinct signs that can clue you in. You may encounter any of these three rental scams in your housing search:

- Phantom listings coax users into sending payments for properties that aren’t even available. These scams, also called ghost listings, may feature questionable photos of properties. Look up a property’s address online and verify its status if you’re ever in doubt.

- Hijacked ads use copy-pasted versions of legitimate ads to mislead renters. Fraudsters may also steal logos from companies and impersonate employees. Suspicious prices and payment requests are major indicators of hijacked ads. Beware of scammers using Zelle to request fake down payments or fees to tour properties.

- Lease-free listings try to trick renters into paying for properties without signing paperwork. Lease agreements exist to protect tenants and landlords, so this scam is a dead giveaway. Avoid any listings that are allegedly lease-free.

Apartment rental scams can be problematic, but it’s entirely possible to distinguish them from authentic listings. You can get back to browsing confidently once you learn which signs to look out for.

How to spot rental scams

From grammatical issues to sketchy photography, rental scams can have tons of red flags. Learning how to catch a rental scammer can take time and diligence. Look out for the following signs while browsing for your next property online.

The price is unrealistic

After hours of searching, you’ve found a beachside duplex with parking for only $500 per month! Seems too good to be true, right? In fact, it may very well be. Exorbitantly low prices are major indicators that an apartment rental scam is at play.

Let your intuition steer you away from properties with dubious price tags. You can also use sites like RentData.org to double-check the average price of properties within a set ZIP code. Learning the average rent range of neighboring properties is a great way to avoid apartment scams and condo fraud.

Incomplete listings

Incomplete listings can signal that something is off with just one glance. Houses and apartments without descriptions, a list of amenities, leasing agent info, or at least one photo of the property are often housing scams in disguise.

Renters should also be skeptical of listings that only feature the bare minimum information. One-sentence descriptions and vaguely worded policies directly contradict best practices for multiple listing services (aka MLSes).

The lister avoids meeting you in person

You’ve set your sights on a cozy condo, but the “realtor” you’ve chatted with for weeks is never available for a face-to-face meeting. This sort of behavior is a major indicator of a rental scam.

Much like an elderly scam, this particular scheme plays on the goodwill of unsuspecting individuals. Fraudsters may offer many seemingly valid reasons as to why they can’t meet you. If you notice a pattern with their excuses or if their answers seem too convenient, it's best to cut off contact as soon as possible.

Requests for deposits via payment apps or wire transfers

419 scams were common during the early days of the internet—fraudsters impersonated Nigerian princes and requested ludicrous sums of money from unwitting users. These days, scammers may use bogus stories to steal funds through payment apps or wire transfers.

These ploys are thankfully easy to spot—if a "realtor" asks for money via a payment app like Cash App or Venmo before you’ve even met them or viewed the property, that’s a major red flag. Stop all communications with this fraudster and report identity theft to the police if you’ve accidentally shared sensitive information.

You get asked for personal information right away

Personal information such as Social Security numbers (SSNs) help government agencies and credit bureaus verify your identity. Criminals may try to use someone else’s personal information to commit fraud like identity theft. Be wary of any rental listings that ask for your SSN or CVV2 code on the back of your credit card.

Diligence is one of the best defenses against rental scams of this caliber; being wary of anyone who immediately asks for your SSN goes a long way. LifeLock Standard is another excellent tool to consider—privacy monitoring, stolen fund reimbursement, and identity restoration assistance are just some features that can help protect against identity theft.

You’re being pushed to sign paperwork without seeing the property

Receiving paperwork for a property that you're excited about is normally a cause for celebration. But this specific rental scam thrusts documents upon unwitting renters before they’ve even had a chance to visit the property they’re interested in.

This scam might be tougher to recognize if you aren't well-versed in real estate or if you’re moving to a new city you’re unfamiliar with. Carefully read any physical or digital documents that come your way. Check for notary signatures and watermarks—or a lack thereof. And when in doubt, ask a lawyer you trust for their advice.

The listing has typos and grammatical errors

Rental listings allow real estate agents, leasing companies, landlords, and property owners to put their best foot forward. Legitimate posters will go to great lengths to include high-quality photos and detailed descriptions to make a great impression on their customers. Should you stumble upon a listing brimming with typos, misused words and phrases, and run-on sentences galore, there's a strong chance the listing isn't legitimate.

Real estate scams that fit this bill are arguably the easiest to notice. Check for typos and grammatical errors in listing descriptions; scammers may misspell local landmarks and street names, which can clue you in on the con very early on.

You notice copy-pasted content in the listing

A lack of authenticity is a common thread among rental scams. Some scammers might try to copy information from a genuine listing and present it as their own. Fraudsters who adopt this approach are likely trying to capitalize on the reputation of a respected source. It's the equivalent of copy-pasting a Wikipedia summary into a book report.

How can you defend yourself from rental scams like this? Simple—fight fire with fire. If a listing seems suspicious, highlight and right-click the questionable content, then select "Search Google for..." From there, compare and contrast what you find on the search results page.

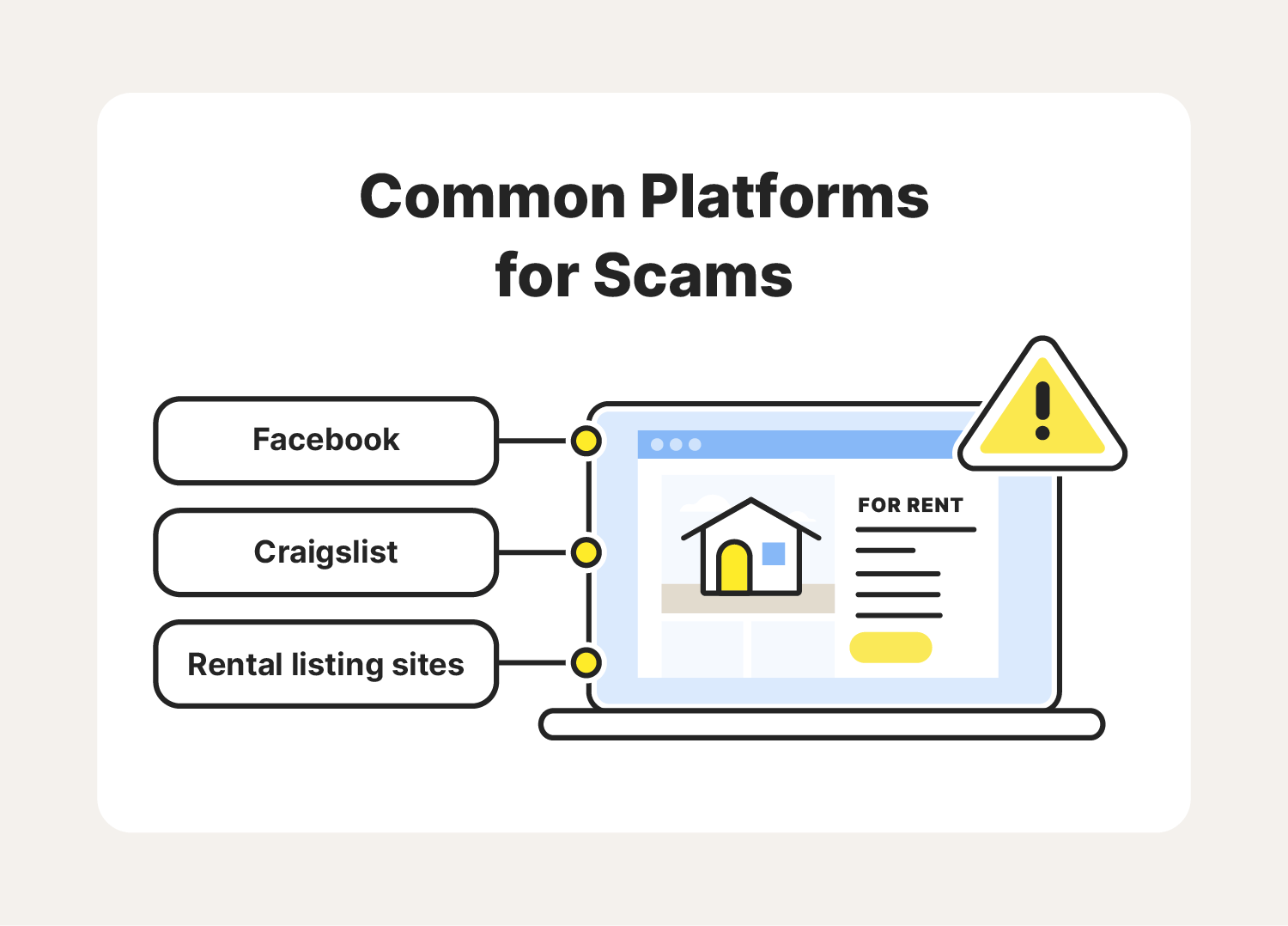

Common platforms for scams

Most websites do their best to keep fraudsters at bay, but some may slip through the cracks. Scammers can set up shop on various platforms ranging from social media sites like Google or Facebook to advertising hubs.

Below are some of the most common platforms where rental scams can occur — and several effective ways to parse them out.

Craigslist

Rental scams on Craigslist often look like bona fide listings at first glance. However, impossibly low prices and suspiciously young accounts are dead giveaways. Don’t provide any money or personal info without verifying the property and the poster. You can also click on the flag icon to report a suspicious post to Craigslist’s staff.

You can find virtually every commodity you can think of on Facebook Marketplace, including rentable properties. Scammers may ask for payments or signatures startlingly quickly. Their profiles might also possess conflicting information from what you discuss with them via Facebook Messenger.

Trusted rental listing sites

Apartments.com, Trulia, and Zillow have all become proficient at handling rental scams. If you find a listing with an alarming price tag or a poster that presses you for cash, swiftly flag them by using each site’s built-in “report listing” feature.

Scammers on any of these sites might use fake accounts to contact you. Carefully inspecting their profile can help you find red flags in their accounts, such as “young” account ages for profiles that were recently created.

8 tips to avoid rental scams

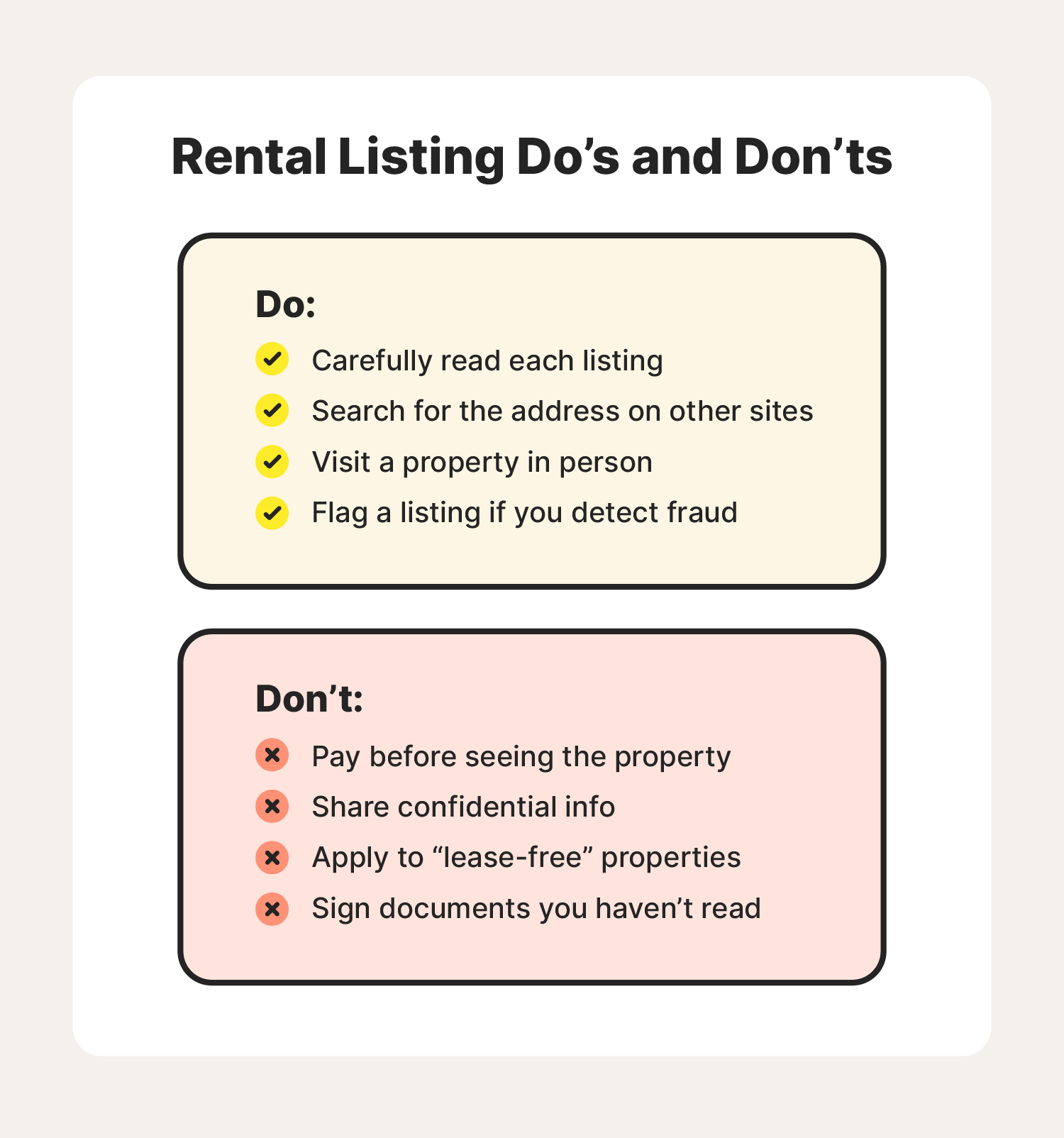

Remembering every single detail about rental scams can feel overwhelming, but there are several simple tips renters can fall back on while looking for properties.

- Do your research on listing agents and companies. You can find most listing agents on trustworthy platforms like LinkedIn, and you can locate companies in the Better Business Bureau directory.

- Make sure the property isn’t listed for rent in more than one area. If a property you’re keen on is listed in multiple cities or states, that’s a red flag.

- Search for the address online and use street view to scope out the property. This method can ensure photos of a property are accurate and up to date.

- Always visit and tour the unit in the listing. This can help establish trust between you and the landlord, and build confidence in your purchase.

- Meet the landlord in person and verify any previous phone calls. This will clear any confusion on the chance you spoke with a scammer over the phone.

- Share any documents you receive with a legal representative. An attorney may notice certain discrepancies that the average person can’t.

- Avoid sending money via payment apps. Once you’ve made a payment, the other party would have to willingly reimburse you, which isn’t likely during a scam.

- Reach out to your county’s tax assessor to see who owns a given property. Tax assessors maintain detailed and up-to-date records of properties within a given area.

When you’re learning how to avoid rental scams, practice makes perfect. Trust your instincts while you're browsing online. After all, you can never be too cautious when your finances and sensitive information are involved.

Help protect against rental scams with LifeLock Standard

Rental scams can be avoidable, especially if you know what to watch out for. The more you learn, the more confident you'll be when searching for properties online. But sometimes, prevention isn't enough. To help increase your peace of mind, consider using LifeLock Standard for one-bureau credit monitoring, stolen funds reimbursement, and 24/7 identity monitoring to alert you of fraud.